Economic recovery after COVID-19 crisis

Types

of economic recoveries

It has been almost over a half year has elapsed from first-ever novel coronavirus case recorded in the People’s republic of China. In this, a couple of quarters the world had witnessed a bunch of unexpected scenarios which had directly or indirectly affected the normal life of Homo sapiens.

COVID-19 has claimed 602K lives and infected over 14 million people

across the globe. The curve shows no signs of slowing down in the coming

month or so. As the virus is highly contagious governments have to impose strict

lockdowns in their respective countries.

This result in loss of revenue to the firms and people start losing their jobs. Many firms have filed for bankruptcy whereas many firms have asked for govt. help to sustain the current crisis. As a wise man said, every cloud has a silver lining. The cases in a bunch of nations seem to slow down and authorities are gradually opening its economy.

Governments have proposed many different ways such as establishing a bubble etc. but the question arises how can the economy recover from the current crisis? There is an answer to the aforementioned question in economics.

As per theories, there are 3 ways how an economy can recover but in

modern economics, there are 5 ways.

1.

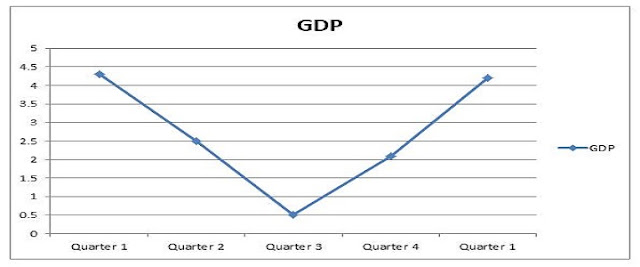

“V” shaped of recovery –

“V” shaped of recovery is a very common

and basic form of recovery. With this type of recovery, the economy contracts to a

point and bounces back just after that point.

As shown in the above figure the GDP falls

continues till quarter 3 but after that point, we witness some kind of recovery

and with the next couple of weeks economy gets back to its previous levels.

This type of recovery resembles the English letter V that’s why it is called as

“V” shape of the recovery.

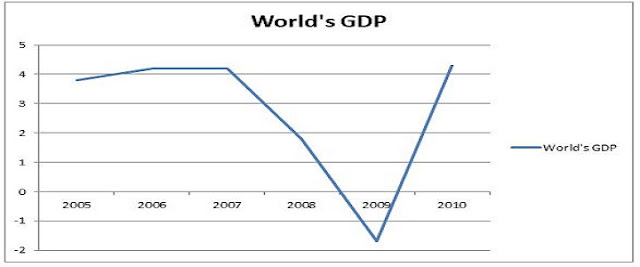

The biggest example of this type of recovery is the 2008-2009 financial crisis.

-

www.worldometers.info

As seen in the above figures, world GDP drooped as the 2008 crisis emerged

but in 2010 we saw a recovery.

Why we might see “V” shaped of recovery

In the case of the current economic crisis, we might see the “V” shaped

of recovery as the present recession is occurring due to the implementation of

lockdown from the respected government. The economic output of firms has

declined due to a decline in demand in the market, and as the demand gets restored

companies can start gaining profit and the economy can start recovering.

Why we might not see “V” shaped of recovery

Restoring demand to pre-coronavirus era might not be sufficient. As

people across the globe have lost their jobs and many businesses have recorded

historical losses. So just demand and supply cannot solve the current crisis.

Nations attitude towards China will also play a major role in recovery. Unrest

in middle-east and near the South China Sea can hugely impact the structure

of the curve.

2.

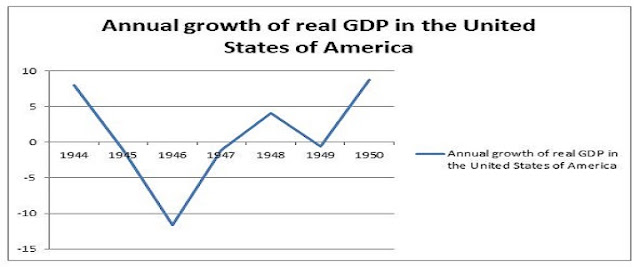

“W” shaped of recovery –

“W” shaped of

economic recovery is just an extension of “V” shaped of economic recovery. This

type of recovery usually occurs in uncertain economic scenarios. The

economy falls immediately again after recovery.

As shown in the above

figure Economy falls but after a short gain, it fell again. The biggest example

of this type of recovery is The Great Depression.

In the case of coronavirus, we can witness “W” shaped of recovery only if we face the second wave of infection. In that case, the government again has to impose restrictions which can lead to “W” shaped recovery.

There is also another chance of “W” shaped recovery is war. If the world

faces another war then also we can witness the “W” shaped recovery but the second dip on the curve will depend upon the gravity of the war. With the current situation in the world, we cannot fully write-off both of the

situations.

3.

“U” shaped of recovery –

“U” shaped recovery is the opposite of a “V” type of recovery. The

economy does not bounce back after a crisis. The economy took some time to

recover and which result in “U” shape. In its economy, it can take longer than

usual and this phase can last from 2 quarter or more.

The chances of “U” shaped economy are very low. As the world is become

very competitive and with the current population of the world. The world

economy might not face a “U” shaped recovery but many firms and industries

might face it. These industries include Hospitality & Travel etc. In it, we

might not see much of the demand and can witness a low demand for at least a

couple of quarters or more.

4.

“Swoosh” shaped of recovery –

“Swoosh” shaped of recovery or more commonly known as “L” shaped of

recovery is the very basic type of recovery. In it, when an economy falls the

recovery phase is longer than usual and can take a half year or more in some

conditions to get to the previous level.

We have witnessed “Swoosh” shaped of recovery in the early and

mid-1900s at that time economy was not evolved and globalised compared to

current economic conditions. Presently economies are open and competitive.

Thus “L” shaped is strenuous.

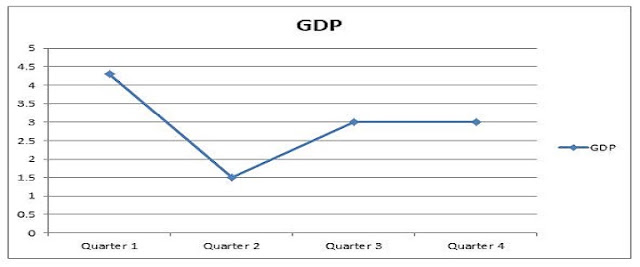

5. “Reverse Square Root” shaped of recovery–

Reverse Square root shaped recovery can occur when the economy can

recover from the slowdown but fails to gain previous levels. In this situation,

the economy tops the level well below the previous high.

As shown in the

figure, the economy is not able to reach the initial level. This can happen due

to the significant change in the taste, habit or preferences of consumer

behaviour. In it, the actual recovery time can go as high as a couple of years.

The chances of

this type of recovery is very low but some industry can show us this type of

recovery such as airline industry etc.

Conclusion

Coronavirus has

affected our economy very badly. This type of recession has raised new

questions and pushed economists to think outside the box to counter the

situation. Although I feel that there is one more issue that we might able to

face shortly is tension between China and other countries. Doomsday clock is

almost 100 seconds before midnight, with Beijing consciously calming other

countries' land. We can only hope this aggression will not trigger any war-like the situation, the war in the current situation can only cause havoc.

the loan company that grants me loan of 5,000,000.00 USD When other loan investors has neglect my offer but mr benjamin lee granted me success loan.they are into directly in loan financing and project in terms of investment. they provide financing solutions to companies and individuals seeking access to capital markets funds, they can helped you fund your project or expand your business.. Email Contact:::: Also 247officedept@gmail.com or Write on whatsapp Number on +1-(989-394-3740)

ReplyDelete